Wire Rope Manufacturers Insurance Policy Information

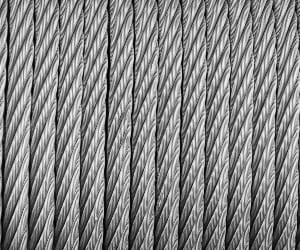

Wire Rope Manufacturers Insurance. Wire rope - also sometimes called aircraft cable - may at first glance appear to be rather simple. It is, however, a complex tool that is often designed for equally complex purposes.

Seven or more strands of wire are coiled together into a new, much stronger, rope. Each new strand that results can, in turn, be used to form an even more robust rope wire as its strands are wrapped around a core.

Wire rope manufacturers produce wire cables made of seven or more strands of steel or other metal for industrial use. Wire is generally purchased from other manufacturers on large drums. It may be annealed, heat-treated, electroplated, coated, wrapped, twisted, or braided into rope or cable.

Fittings and attachments, such as cinches and beads, may be added to adapt it to a particular use. The finished rope or cable is coiled onto large drums for shipping.

With an impressive spectrum of industrial applications, wire rope is vital in aerospace, construction (including, for instance, in elevators), and any other industry that relies on strong ropes to lift and let down massive loads, such as distilleries and oil rigs.

In each case, the wire rope has to be precisely engineered to fulfill its intended purpose. The design, diameter, metal used (commonly steel, bronze, and iron), and lubrication all play a role in determining the ultimate capabilities of a wire rope.

The fact that any malfunction would very often have catastrophic consequences, both in human and economic terms, is just one reason why it is so essential for companies that manufacture these impressive products to be properly insured. What kinds of wire rope manufacturers insurance are needed? To find out more, read on.

Wire rope manufacturers insurance protects your manufacturing business from lawsuits with rates as low as $57/mo. Get a fast quote and your certificate of insurance now.

Below are some answers to commonly asked wire rope manufacturing insurance questions:

- What Is Wire Rope Manufacturers Insurance?

- How Much Does Wire Rope Manufacturers Insurance Cost?

- Why Do Wire Rope Manufacturers Need Insurance?

- What Type Of Insurance Do Wire Rope Manufacturers Need?

- What Does Wire Rope Manufacturers Insurance Cover & Pay For?

What Is Wire Rope Manufacturers Insurance?

Wire rope manufacturers insurance is a type of insurance coverage specifically designed for companies that manufacture and distribute wire ropes. This coverage protects against potential losses or damages that may occur during the production, storage, transportation, and installation of wire ropes.

The insurance policy covers financial losses related to product liability, property damage, workers' compensation, and general liability. This insurance helps manufacturers to protect their assets, cover legal expenses, and ensure business continuity in the event of an unexpected loss or damage.

How Much Does Wire Rope Manufacturers Insurance Cost?

The average price of a standard $1,000,000/$2,000,000 General Liability Insurance policy for small wire rope manufacturing businesses ranges from $57 to $79 per month based on location, size, revenue, claims history and more.

Why Do Wire Rope Manufacturers Need Insurance?

All business owners want their companies to be successful, to thrive, and to become leaders in their field. To achieve this goal, it is crucial to be cognizant of all the risks your company could encounter.

Companies that manufacture wire rope have to contend both with risks common to all commercial ventures and threats more specific to their own field - all of which have the potential to threaten the company's financial health.

Examples of dangers any business with physical assets could fall victim to are theft, vandalism, and the breakdown of essential machinery without which you cannot continue production. Acts of nature such as earthquakes, hurricanes, wildfires, and floods can also threaten any business by damaging its facility and its contents.

Companies that manufacture wire rope further have to evaluate what can go wrong within their specific field. Should an employee become injured in the workplace, your company is likely to be held liable for the expenses that result.

Likewise, the malfunction of just one strand within a wire rope can cause its weight-bearing capacity to fail, in turn releasing the heavy load it was bearing and potentially causing both significant property damage and bodily injury or even death.

Even if such a malfunction resulted from user error or improper maintenance, wire rope manufacturers may be sued in these circumstances.

These and other challenges can, without the right wire rope manufacturers insurance, be nothing short of catastrophic - and that is why investing in a top-notch insurance plan that takes your company's risk profile into account is absolutely essential.

What Type Of Insurance Do Wire Rope Manufacturers Need?

Because your insurance coverage is a crucial part of your risk management strategy, wire rope manufacturers should be aware that there are no shortcuts.

Factors like the kind of wire rope you produce, the jurisdiction within which your manufacturing facility is based, the size of your operation, your number of employees, and the machinery you use in your production line all shape the exact type of coverage that you need to protect your business.

All companies in this industry will, however, require the following types of wire rope manufacturers insurance coverage:

- General Liability: Essential in the event that a third party files a lawsuit alleging that your company caused property damage or bodily injury, this type of coverage helps you pay for legal and settlement fees.

- Product Liability: This form of insurance offers liability coverage relating to the rope wire you manufacture. Should a manufacturing error or malfunction cause harm of any kind to a third party, product liability insurance will prove to be vital in protecting your company.

- Commercial Property: This type of wire rope manufacturers insurance shields your company from the financial fallout that might otherwise occur if your facility is hit by unforeseen circumstances such as fire, theft, or vandalism. It can cover not only your physical building and all assets therein, but can also compensate you for revenue lost to these events.

- Workers' Compensation: If an employee sustains a work-related accident or injury, this kind of insurance pays for their medical expenses and any wages they lose if they are unable to return to work.

Wire rope manufacturers should be aware that these types of insurance, while invaluable, are merely examples of the kind of coverage they may require.

Consulting a commercial insurance agent who is familiar with your field is an important step in building a comprehensive wire rope manufacturers insurance program that will protect your business against all the perils it may face.

Wire Rope Manufacturing's Risks & Exposures

Premises liability exposures are low due to limited access by visitors. If tours are given or outsiders are allowed on premises, visitors may be injured by slips, trips, or falls. The storage of spools of cable in the open could pose an attractive nuisance hazard unless the yard is fenced with proper lighting and warnings. Fumes and noise from processing may affect neighboring properties.

Products liability exposure can be very high as the manufacturer is the final point of quality control before delivery to the customer. While the wire rope manufacturer only attaches fittings and terminals, it is often at the juncture that failure occurs. Bodily injury or property damage could be extensive if cables securing elevators or lifting heavy machinery should fail.

Severe losses could result from product failure in automotive, aerospace, or military applications.

Environmental impairment exposure may be significant due to possible contamination of ground, air, and water from the degreasers, solvents, chemicals to clean or coat, and their storage and disposal. There may be outdoor or underground storage tanks on premises with the potential for spillage and contamination.

If there are underground tanks, a UST policy will be required. Disposal of wastes must adhere to all federal and state guidelines.

Workers compensation exposures are very high due to the possibility of burns from hot metal, chemicals, or welding. Injuries from production machinery are common, as are slips, trips, and falls, foreign objects in the eye, back injuries from lifting, hearing loss from noise, and repetitive motion injuries. Workstations should be ergonomically designed.

Employees should be provided with safety training and protective equipment. Areas that generate dust require respiratory protection devices, as well as eye protection and eye wash stations. Guards should be on machinery, especially the cutting and shearing devices, and workers should not be allowed to remove guards due to the possibility of cuts and amputations during processing.

Chemical burns and eye, skin, and lung irritants can present long-term occupational disease.

Property exposures consist of an office, shop, and warehouse or yard for storage of raw materials and finished goods. Ignition sources include electrical wiring, heating systems, production machinery, annealing, heat treating, and sparks from welding operations.

Tanks and gasses should be stored away from flammables, and the welding should be conducted away from other operations. The cutting and shearing can produce dust and metal scraps. Poor housekeeping, such as failure to collect and dispose of trash on a regular basis, could contribute significantly to a loss.

Degreasers, solvents, chemicals to clean or coat, and other flammables must be adequately controlled. Unless disposed of properly, greasy, oily rags (such as those used to clean machinery) can cause a fire without a separate ignition source.

The stock itself is not usually susceptible to fire or water damage and is not a target item for theft.

Equipment breakdown exposures include malfunctioning production equipment, electrical control panels, and other apparatus. A lengthy breakdown to production machinery could result in a severe loss, both direct and under time element.

Crime exposures are chiefly from employee dishonesty and theft, particularly if there are exotic metals. Background checks should be conducted on all employees. There must be a separation of duties between persons handling deposits and disbursements and handling bank statements.

The manufacturer should have security methods in place to prevent theft.

Inland marine exposure includes accounts receivable if the manufacturer offers credit, computers (which may include computer-run production equipment), goods in transit, and valuable papers and records for customers' and suppliers' information.

Backup copies of all records should be made and stored off premises. Stock in transit is not usually susceptible to damage except from collision or overturn.

Business auto exposure can be high if the manufacturer picks up or delivers drums of coiled wire rope to customers. Transportation of loads requires careful loading and tie-down to prevent shifts that may cause overturn, collision or dumping of a load onto a public road during transport. Manufacturers generally have private passenger fleets used for sales.

There should be written procedures regarding the private use of these vehicles by others. Drivers should have an appropriate license and an acceptable MVR. All vehicles must be well maintained with documentation kept in a central location.

What Does Wire Rope Manufacturers Insurance Cover & Pay For?

Wire rope manufacturers, like any other business, can face a variety of legal challenges that can result in lawsuits. Here are some common reasons they might be sued, along with how insurance can help mitigate these risks:

1. Product Liability: This is perhaps the most common reason for lawsuits in the manufacturing sector. If a wire rope product fails or causes harm or injury, customers might sue the manufacturer for damages. Insurance can help here with a policy called Product Liability Insurance. This insurance helps cover the legal and court costs of defending against claims of injury, illness, or damage caused by a defective product. It can also help pay any judgments or settlements up to the policy limits.

2. Breach of Warranty or Contract: If a wire rope manufacturer fails to meet the terms of a contract or warranty, they may be sued by their clients. Commercial General Liability (CGL) Insurance can help protect against these types of claims. CGL insurance covers claims for bodily injury, property damage, and personal and advertising injury (which includes breach of contract) that could arise from the business operations.

3. Employee Injuries: Manufacturing environments can be hazardous, and employees may be injured on the job. If an employee believes their injury was due to employer negligence, they could sue. Workers Compensation Insurance helps in these situations. This insurance can cover medical bills, disability payments, and legal costs if an injured employee decides to sue. It's worth noting that in many jurisdictions, accepting workers' compensation benefits waives an employee's right to sue their employer.

4. Intellectual Property Infringement: A wire rope manufacturer may be sued if they are accused of copying or stealing another company's patented design or process. Intellectual Property (IP) Insurance can be purchased to protect against such lawsuits. IP insurance typically covers legal fees and any potential settlements or judgments.

5. Environmental Damage: Manufacturing processes can sometimes result in environmental damage. If a wire rope manufacturer is found to be responsible for such damage, they could face legal action. Environmental Impairment Liability (EIL) Insurance can help protect against these types of claims. This insurance can cover the costs associated with clean-up efforts, as well as legal fees and any resulting fines or penalties.

It's important to remember that while insurance can provide significant protection against these and other risks, it is not a panacea. Manufacturers should also implement strong risk management practices to minimize the chances of facing a lawsuit in the first place.

Commercial Insurance And Business Industry Classification

- SIC CODE: 3496 Miscellaneous Fabricated Wire Products

- NAICS CODE: 332618 Other Fabricated Wire Product Manufacturing

- Suggested Workers Compensation Code(s): 3240 Wire Rope or Cable Manufacturing - Iron or Steel

Description for 3496: Miscellaneous Fabricated Wire Products

Division D: Manufacturing | Major Group 34: Fabricated Metal Products, Except Machinery And Transportation Equipment | Industry Group 349: Miscellaneous Fabricated Metal Products

3496 Miscellaneous Fabricated Wire Products: Establishments primarily engaged in manufacturing miscellaneous fabricated wire products from purchased wire, such as non-insulated wire rope and cable; fencing; screening, netting, paper machine wire cloth; hangers, paper clips, kitchenware, and wire carts. Rolling mills engaged in manufacturing wire products are classified in Major Group 33. Establishments primarily engaged in manufacturing steel nails and spikes from purchased wire or rod are classified in Industry 3315; those manufacturing nonferrous wire nails and spikes from purchased wire or rod are classified in Industry 3399; those drawing and insulating nonferrous wire are classified in Industry 3357; and those manufacturing wire springs are classified in Industry 3495.

- Antisubmarine and torpedo nets, made from purchased wire

- Barbed wire, made from purchased wire

- Baskets, made from purchased wire

- Belts, conveyor: made from purchased wire

- Belts, drying made from purchased wire

- Bird cages, made from purchased wire

- Bottle openers, made from purchased wire

- Cable, uninsulated wire: made from purchased wire

- Cages, wire: made from purchased wire

- Carts, grocery: made from purchased wire

- Chain, welded: made from purchased wire

- Chain, wire: made from purchased wire

- Clips and fasteners, made from purchased wire

- Cloth, woven wire: made from purchased wire

- Concrete reinforcing mesh, made from purchased wire

- Cylinder wire cloth, made from purchased wire

- Delivery cases, made from purchased wire

- Diamond cloth, made from purchased wire

- Door mats, made from purchased wire

- Fabrics, woven wire: made from purchased wire

- Fencing, made from purchased wire

- Florists' designs, made from purchased wire

- Fourdrinier wire cloth, made from purchased wire

- Gates, fence: made from purchased wire

- Grilles and grillework, woven wire: made from purchased wire

- Guards, made from purchased wire

- Hangers, garment: made from purchased wire

- Hardware cloth, woven wire: made from purchased wire

- Hog rings, made from purchased wire

- Insect screening, woven wire: made from purchased wire

- Key rings, made from purchased wire

- Keys, can: made from purchased wire

- Kitchen wire goods, made from purchased wire

- Lamp frames, wire: made from purchased wire

- Lath, woven wire: made from purchased wire

- Mats and matting, made from purchased wire

- Mesh, made from purchased wire

- Netting, woven wire: made from purchased wire

- Paper clips and fasteners, made from purchased wire

- Paper machine wire cloth, made from purchased wire

- Partitions and grillework, made from purchased wire

- Postal screen wire equipment

- Potato mashers, made from purchased wire

- Poultry netting, made from purchased wire

- Racks without rigid framework, made from purchased wire

- Rods, gas welding: made from purchased wire

- Rope, uninsulated wire: made from purchased wire

- Screening, woven wire: made from purchased wire

- Shelving without rigid framework, made from purchased wire

- Sieves, made from purchased wire

- Skid chains, made from purchased wire

- Slings, lifting: made from purchased wire

- Spiral cloth, made from purchased wire

- Staples, wire: made from purchased wire

- Strand, uninsulated wire: made from purchased wire

- Ties, bale: made from purchased wire

- Tire chains, made from purchased wire

- Traps, animal and fish: made from purchased wire

- Trays, made from purchased wire

- Wire and wire products: except insulated wire, and nails and

- Wire winding of purchased wire

- Wire, concrete reinforcing: made from purchased wire

- Woven wire products, made from purchased wire

Wire Rope Manufacturers Insurance - The Bottom Line

Wire rope manufacturers insurance policies can be very different in premiums, coverages and exclusions. You can see if your business has the best fit insurance policies by talking to an experienced commercial insurance broker.

Often they are able to save you on premiums and offer you better policy options than you currently have.

Additional Resources For Manufacturing Insurance

Learn all about manufacturing insurance. Manufacturers face many unique risks such as product libility and/or product recall exposures due to the nature of their business operations.

- 3D Printing

- Adhesives

- Alarms

- Audio & Video Equipment

- Auto Parts

- Bottling Plants

- Boxes

- Bricks

- Brooms & Brushes

- Buttons

- Cabinets

- Camping Equipment

- Canned Fruit & Vegetables

- Cans

- Canvas Products

- Caskets

- CBD Oil And Hemp

- Cement

- Ceramics

- Chemical

- Clock & Watch

- Clothing

- Coffee

- Commercial Air Conditioning

- Commercial Electronics

- Communications Equipment

- Computers

- Condoms

- Construction Equipment

- Cork Products

- Cosmetics

- Cutlery

- Dairies & Creameries

- Down And Feather Products

- Dry Ice

- Dyes & Pigments

- Electronic Toys & Games

- Electroplating

- Elevators

- Engines

- Exercise Equipment

- Farm Equipment

- Feed & Grain

- Fences

- Fertilizer

- Fireworks

- Flavoring Extracts

- Frozen Foods

- Fruit Juice

- Fur Garment

- Garage Door

- Gears

- Glass

- Glasswear

- Gypsum Products

- Hosiery

- Ice Cream

- Industrial Equipment

- Ink

- Insecticides

- Iron & Steel Foundries

- Jewelry

- Lawn Mowers

- Leather Apparel

- Leather Goods

- Lighting & Wiring

- Lumber & Wood Products

- Machine Shop

- Major Electrical Appliances

- Manufacturing

- Marijuana Products

- Mattresses & Box Springs

- Metal & Plastic Furniture

- Metal Heat Treating

- Metal Toys

- Millwork

- Monuments

- Musical Instruments

- Nanotechnology

- Nonferrous Foundries

- Ornamental Metalwork

- Paint

- Paper & Allied Products

- Pesticides

- Pet Food

- Pharmaceuticals

- Plastic & Rubber Toys

- Plastic Goods

- Plastics

- Plastics Molding, Forming & Extruding

- Pottery

- Product Liability

- Prosthetics

- Psychedelic Drugs

- Pulp & Paper Mills

- Refractory

- Residential Air Conditioning & Heating

- Rubber Goods

- Rugs

- Sawmills & Planing Mills

- Screw Machine Products

- Sheet Metal

- Soap & Detergent

- Shoes

- Small Electrical Appliances

- Sporting Goods

- Springs

- Stone Products

- Tanneries

- Textiles

- Textiles Finishing & Coating

- Tires

- Tobacco

- Tool & Die Shops

- Vegetable Juice

- Vending Machines

- Watercraft

- Wire

- Wire Rope

- Wood Furniture

- Woodworking

- Writing Instruments

- Yarn

- Specialty Manufacturing

- Specialty Product Liability

The manufacturing industry is a vital part of the economy and plays a significant role in the production of goods and services. However, it is also an industry that is prone to risks and accidents, which can result in costly damages and lawsuits. Therefore, it is essential for businesses in the manufacturing industry to have insurance to protect them against potential losses.

Business insurance can cover a wide range of risks, including property damage, liability, and worker injuries. For instance, if a fire were to break out in a manufacturing facility and destroy equipment or inventory, commercial insurance could cover the costs of replacing or repairing the damages. Similarly, if a worker were to be injured on the job, business insurance could cover medical expenses and lost wages.

In addition to protecting against physical damages, insurance can also provide financial protection against legal liabilities. If a customer were to sue a manufacturing business for a faulty product, the commercial insurance could cover the costs of legal fees and settlements.

Overall, insurance is essential for the manufacturing industry as it helps to mitigate risks and protect against unexpected costs. Without it, businesses in the industry could face financial ruin in the event of an accident or lawsuit.

Minimum recommended small business insurance coverage: Building, Business Personal Property, Business Income with Extra Expense, Equipment Breakdown, Employee Dishonesty, Accounts Receivable, Computers, Goods in Transit, Valuable Papers and Records, General Liability, Employee Benefits Liability, Environmental Impairment Liability, Umbrella Liability, Hired and Non-owned Auto Liability & Workers Compensation.

Other commercial insurance policies to consider: Earthquake, Flood, Cyber Liability, Employment-related Practices Liability, Business Auto Liability and Physical Damage and Stop Gap Liability.