Psychedelic Drugs Manufacturers Insurance Policy Information

Psychedelic Drugs Manufacturers Insurance. Over the next few years, Psychedelic drugs will become mainstream mainly because there is a lot of research to back claims of them being effective at alleviating numerous health issues.

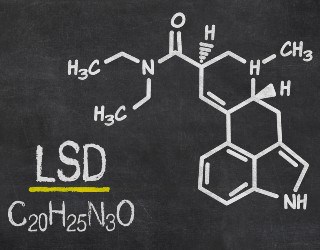

The pharmaceutical industry is increasingly studying drugs like LSD, ketamine, and psilocybin, and their effects on mental illnesses are now making it to scientific journals across the world.

Psychedelics are made from a variety of raw materials which may be organic, chemical, or synthetic. Processes may include aeration, blending, crushing, filtering, freezing, heating, mixing, molding, pressurizing, or washing.

The end product may take a variety of forms such as capsule, jelly, liquid, pill, powder, spray (aerosol or non-aerosol), or time-release patch. Cleanliness, purity, and the proper mix of ingredients are critical.

Pharmaceutical manufacturers have laboratories engaged in product development, testing, and quality control. Products must pass rigid clinical trials before being approved by the Food and Drug Administration (FDA) for use by consumers.

In the past decade or so, the US has seen somewhat of a surge in research regarding the benefits of psychedelic drugs being used in medicine or for therapy. It is expected that the psychedelic drug market in North America will grow by an expected 15.8 percent each year, and reach a value of $6,846 million by around 2027, making it a highly lucrative category of drugs for the pharmaceutical industry.

In other words, we can expect to see an increasing number of pharmaceutical companies manufacturing psychedelics which also means that manufacturers will require insurance.

So, the question is will psychedelic drugs manufacturers insurance be different from regular pharmaceutical company insurance?

Psychedelic drugs manufacturers insurance protects your manufacturing business from lawsuits with rates as low as $97/mo. Get a fast quote and your certificate of insurance now.

Below are some answers to commonly asked psychedelic drugs manufacturing insurance questions:

- What Is Psychedelic Drugs Manufacturers Insurance?

- How Much Does Psychedelic Drugs Manufacturers Insurance Cost?

- Why Do Psychedelic Drugs Manufacturers Need Insurance?

- What Type Of Insurance Do Psychedelic Drugs Manufacturers Need?

- How Should Manufacturers Of Psychedelics Buy An Insurance Policy?

- What Does Psychedelic Drugs Manufacturers Insurance Cover & Pay For?

What Is Psychedelic Drugs Manufacturers Insurance?

Psychedelic drugs manufacturers insurance is a type of liability insurance that provides coverage for manufacturers of psychedelic drugs against any potential legal claims or financial losses related to the production and distribution of these drugs.

The insurance policy may cover a range of potential risks, including product liability, property damage, and personal injury claims. The coverage can be customized to meet the specific needs of the manufacturer, and the insurance company may require proof of compliance with federal, state, and local laws and regulations.

How Much Does Psychedelic Drugs Manufacturers Insurance Cost?

The average price of a standard $1,000,000/$2,000,000 General Liability Insurance policy for small psychedelic drugs manufacturing businesses ranges from $97 to $139 per month based on location, size, revenue, claims history and more.

Why Do Psychedelic Drugs Manufacturers Need Insurance?

To start with, the psychedelics industry in North America tends to be varied. Companies require board members who have specialized knowledge and also leaders that have a broad understanding of future and current marketplaces. Prime markets for psychedelic drugs include:

The Pharmaceutical Use Industry – Usually, companies in this industry will research to develop various types of drugs, run clinical trials, and other very similar activities. They will often be working with both non-hallucinogenic and hallucinogenic drugs and using a myriad of delivery systems.

Treatment centers and clinics – The activities for these businesses include treating various conditions, like addiction and mental illness in a clinical setting.

Wellness products – Companies in this industry, will develop formulations for numerous wellness and nutraceutical products, using mainly nonpsychoactive ingredients.

Recreational usage – It is also referred to as medical tourism, usually, these companies may include using micro-dosing psilocybin and using truffles recreationally within jurisdictions where these are considered legal.

Now each of the markets we mentioned above is distinct. That's why it is so important for a drug manufacturer manufacturing psychedelics to know if it will cover industry-specific risks faced.

Any company can be sued for product liability, which puts the company's assets at risk. It can also put a strain on the company's financial resources - and that is why psychedelic drugs manufacturers insurance is so important.

What Type Of Insurance Do Psychedelic Drugs Manufacturers Need?

Almost every pharmaceutical drug manufacturer is aware of the fact that the risk associated with a lawsuit can be devastating. That's why it is so crucial that companies get the right type of psychedelic drugs manufacturers insurance policy that protects them against what could be a spectrum of lawsuits, many of which are unforeseen at this early stage of the niche's development.

However, one of the risks that manufacturers will face with their drugs being used for instances of what is considered overdosing, a chemical or allergic reaction to the drug/compound, and other unintended effects, some of which could prove fatal.

An psychedelic drugs manufacturers insurance policy is more like a risk mitigation policy which ensures that a drug manufacturer's financial risks and interests are protected in the event of a lawsuit. However, the choice of what the insurance policy covers, is, for the most part, a decision between the drug manufacturer and the amount of the risk that the insurance company or insurer is willing to absorb.

At present, insurers see psychedelic drug manufacturers as high-risk clients. The risk associated with this niche of the industry is higher than the industry itself, which is why finding an insurance policy at present that offers the best coverage for any amount of money is rare.

In many cases, the insurance service provider will offer a custom policy based on their assessment of the risks and the type of drugs being researched and developed by the manufacturer.

Also, some insurers may provide a drug-specific policy, usually for drugs that are approved for use by the FDA but will not cover drugs that aren't FDA approved.

To make sure you get the right coverage, consult a commercial insurance broker. Having said that, indispensable types of psychedelic drugs manufacturers insurance you will almost certainly require include:

- Commercial Property: This type of psychedelic drugs manufacturers insurance is designed to shield companies from financial losses if their facilities are struck by acts of nature, theft, vandalism, and certain other accidents that cause property loss or damage. It will (partially) cover the costs of damage to their building(s), but also physical assets therein, such as industrial equipment and raw materials.

- Commercial General Liability: Liability insurance exists to help cover the costs associated with third party property damage or physical injury claims. It exists in various subcategories. General liability insurance may cover events such as third parties being injured on a company's property or a malfunction within their facility causing damage to a neighboring property.

- Product Liability: Covers the costs that can follow if a third party, such as a patient, is harmed by a product.

- Product Recall: Designed to cover the expenses associated with product recalls, this type of insurance is also essential to pharmaceutical companies.

- Environmental Or Pollution: Is an essential in case hazardous substances are spilled into the ecosystem.

- Workers Compensation: This type of insurance covers the medical expenses and any lost wages of employees who sustain workplace injuries or illnesses for which the company is held liable.

These types of psychedelic drugs manufacturers insurance are examples of the coverage a maker of psychedelics will need to protect their operations. You may also require other types.

How Should Manufacturers Of Psychedelics Buy An Insurance Policy?

Any maker of psychedelics that's in the market for an psychedelic drugs manufacturers insurance policy needs to keep a couple of things in mind. Ideally, the manufacturer should also have a specialist attorney on board that makes sure the insurance policy covers all potential legal issues that can lead to a lawsuit anytime in the future.

Read the Fine Print – Now, regardless of what you think the policy states, the fine print is perhaps the most important aspect of a pharmaceutical manufacturer's policy. Usually, it will state under what conditions the insurance coverage will not kick in, and knowing this will help fashion your business practices accordingly.

What Type of Coverage Is Offered? – Under what conditions does the insurance policy kick-in? For instance, your liability insurance, like for the manufacturing facility, may cover your financial risk in the event of fire or flood damage. Similarly, you'll want to know what types of risks or damage is covered under the policy you're purchasing. Usually, FDA-approved drugs are covered under the policy.

Psychedelic Drugs Manufacturing's Risks & Exposures

Premises liability exposures are normally low to moderate unless aerosols are manufactured or stored on premises. Although tours may be conducted, access by visitors is usually limited and controlled due to the need for a sterile environment.

Visitors may be injured by slips, trips, or falls, or may be exposed to toxic or caustic chemicals. Fumes, spills, or leaks from tanks may cause serious injury or property damage to neighboring properties.

Pharmaceutical manufacturers generally have traveling sales representatives who visit drug store chains, doctor's offices, and trade shows. Large sales cases or exhibition materials may present tripping hazards that could result in injuries to customers or the general public.

Products liability exposures are severe due to the potential for bodily injury, including sickness and death, to consumers of finished products. Quality control at all phases of the operation from product development to packaging is critical to reduce the exposure to injury.

Significant injuries or damage may follow from improper processing or mixing of ingredients, improper storage, during transport or even inappropriate packaging and labeling.

Packaging should include information addressing possible side effects and inform consumers of action that should be taken in the event of an allergic reaction. Factors affecting risk include whether the medicine produced is available over the counter or by prescription only; whether it is an established medicine (such as aspirin) or is newly developed; and whether it is the result of the manufacturer's research only, or is supported by academic research.

Lack of compliance with government regulations and controls may dramatically increase hazards, and may also make defense of claims difficult. There should be a plan for recalling defective products.

Environmental impairment exposures are very high. Sudden or cumulative discharges of chemicals may contaminate air, surface or ground water, or soil. Disposal procedures must adhere to all EPA and other regulatory standards. Processes themselves may cause thermal or noise pollution. If there are underground tanks, a UST policy will be required.

Workers compensation exposures may be high. Injuries from production machinery are common, as are burns, cuts, slips, trips, falls, hearing loss from machinery noise, and back injuries from lifting. Employees should be provided with safety training and protective equipment. Ergonomically designed workstations can prevent repetitive motion injury.

Aerosol containers may explode and injure workers. Ingredients may be toxic and/or caustic, with a high potential for injury to eyes, lungs, or skin. Workers must be made aware of the potential side effects, including long-term occupational disease hazards, so they can be aware of warning symptoms and obtain treatment as early as possible. Drivers of forklifts and vehicles may be injured in accidents.

Property exposure consists of an office, production plant, and warehousing of raw materials and finished goods. Ignition sources include electrical wiring, heating and cooling equipment, overheating of production machinery, buildup of static electricity, escape of fumes from storage tanks, and refueling of forklifts.

The large draft spaces in storage warehouses can contribute to the spread of a fire. Flammable lubricants and cleaning agents may be stored on premises. Some chemicals and final products may be spoiled by temperature change, humidity, dust or other factors. Due to the sterile conditions that must be maintained throughout the manufacturing process, even a small fire can result in a total loss to stock.

Raw ingredients and finished stock are expensive, and may be targeted by thieves who anticipate profits from black market sales. Vandalism can result from protestors. Appropriate security controls should be taken including physical barriers to prevent entrance to the premises after hours and an alarm system that reports directly to a central station or the police department.

Business interruption exposure can be high because a large loss can result in lengthy downtime for repairing or replacing production equipment.

Equipment breakdown exposures include breakdown losses of processing systems, heating and cooling equipment, electrical control panels, and other apparatus. Breakdown and loss of use to the production machinery could result in significant loss, both direct and indirect, such as, time element.

Crime exposures are chiefly from employee dishonesty and theft of money and securities. The black market for pharmaceuticals, particularly controlled substances, makes many drugs and/or their raw ingredients targets for theft.

Employees may act alone or in collusion with outsiders in stealing money, raw materials, trade secrets, or finished stock. Background checks should be conducted on all employees. There must be a separation of duties between persons handling deposits and disbursements and handling bank statements.

Inland marine exposures include accounts receivable if the manufacturer offers credit to customers, computers (which may include computer-run production equipment), goods in transit, and valuable papers and records for customers' and suppliers' information as well as quality control testing results and proprietary formulas used for drugs.

Goods in transit may be damaged by fire, theft, collision and overturn, spillage, contamination or aerosol explosion. Some products require shipment in refrigerated vehicles to prevent spoilage.

Commercial auto exposure may be very high if the manufacturer transports raw materials or finished products. Haz Mat licenses may be required. Manufacturers generally have private passenger fleets used by sales representatives. There should be written procedures regarding the private use of these vehicles by others. Each driver should have an appropriate license and an acceptable MVR.

All vehicles must be well maintained with documentation kept in a central location. Transport of aerosols is hazardous because the products need to be kept at cooler temperatures. Refrigerated trucks used for this purpose as well as the transport of other drugs sensitive to temperature changes should be well maintained to prevent overheating and explosion.

What Does Psychedelic Drugs Manufacturers Insurance Cover & Pay For?

Psychedelic drug manufacturers, like any other business, can face lawsuits for a number of reasons. Here are a few examples of potential grounds for lawsuits, along with ways that insurance could protect them:

1. Product Liability: If a consumer alleges that they have been harmed due to the use of a psychedelic drug, they may sue the manufacturer for damages. This can include physical harm, psychological harm, or even wrongful death claims. In such cases, a product liability insurance policy can provide protection. This type of insurance covers legal costs associated with defending the claim, as well as any damages awarded to the plaintiff if the manufacturer is found to be at fault. Insurance can help pay for legal defense, court costs, and settlement or judgment costs.

2. Misrepresentation or False Advertising: If a manufacturer is alleged to have misrepresented the effects, risks, or benefits of their product, they may face a lawsuit. This can occur if the company makes false or misleading statements in their advertising or product labeling. A professional liability or errors and omissions (E&O) insurance policy can help cover the costs of such lawsuits. This type of insurance can cover the costs of defending the lawsuit, as well as any damages awarded if the manufacturer is found to be at fault.

3. Breach of Contract: Manufacturers may have contracts with suppliers, distributors, and other business partners. If the manufacturer fails to fulfill their obligations under these contracts, they may be sued for breach of contract. Commercial general liability (CGL) insurance often includes coverage for such lawsuits. It can help pay for the cost of legal defense, and if the manufacturer is found to be at fault, it can also cover the cost of any awarded damages.

4. Intellectual Property Infringement: If a manufacturer is alleged to have infringed on another company's patent, trademark, or copyright, they could face a lawsuit. Intellectual property (IP) insurance can help cover the costs associated with defending against such claims, as well as any damages that might be awarded if the manufacturer is found to have infringed.

It's important for any business, including psychedelic drug manufacturers, to work closely with their insurance provider to ensure that they have the right types and amounts of coverage to adequately protect their business. Insurance is a critical risk management tool that can help protect a company's financial stability in the face of legal challenges.

Commercial Insurance And Business Industry Classification

- SIC CODE: 2833 Medicinal Chemicals And Botanical Products, 2834 Pharmaceutical Preparations

- NAICS CODE: 325411 Medicinal and Botanical Manufacturing, 325412 Pharmaceutical Preparation Manufacturing

- Suggested Workers Compensation Code(s): 4825 Extract Manufacturing, 4611 Cosmetics Manufacturing, 8045 Store - Drug - Retail, 8047 Store - Drug - Wholesale

Description for 2833: Medicinal Chemicals And Botanical Products

Division D: Manufacturing | Major Group 28: Chemicals And Allied Products | Industry Group 283: Drugs

2833 Medicinal Chemicals And Botanical Products: Establishments primarily engaged in: (1) manufacturing bulk organic and inorganic medicinal chemicals and their derivatives and (2) processing (grading, grinding, and milling) bulk botanical drugs and herbs. Included in this industry are establishments primarily engaged in manufacturing agar-agar and similar products of natural origin, endocrine products, manufacturing or isolating basic vitamins, and isolating active medicinal principals such as alkaloids from botanical drugs and herbs.

- Adrenal derivatives: bulk, uncompounded

- Agar-agar (ground)

- Alkaloids and salts

- Anesthetics, in bulk form

- Antibiotics: bulk uncompounded

- Atropine and derivatives

- Barbituric acid and derivatives: bulk, uncompounded

- Botanical products, medicinal: ground, graded, and milled

- Brucine and derivatives

- Caffeine and derivatives

- Chemicals, medicinal: organic and inorganic bulk, uncompounded

- Cinchona and derivatives

- Cocaine and derivatives

- Codeine and derivatives

- Digitoxin

- Drug grading, grinding, and milling

- Endocrine products

- Ephedrine and derivatives

- Ergot alkaloids

- Fish liver oils, refined and concentrated for medicinal use

- Gland derivatives: bulk uncompounded

- Glycosides

- Herb grinding, grading, and milling

- Hormones and derivatives

- Insulin: bulk, uncompounded

- Kelp plants

- Mercury chlorides, U.S.P.

- Mercury compounds, medicinal: organic and inorganic

- Morphine and derivatives

- Oils, vegetable and animal: medicinal grade refined and concentrated

- Opium derivatives

- Ox bile salts and derivatives: bulk, uncompounded

- Penicillin: bulk, uncompounded

- Physostigmine and derivatives

- Pituitary gland derivatives: bulk, uncompounded

- Procaine and derivatives: bulk, uncompounded

- Quinine and derivatives

- Reserpines

- Salicylic acid derivatives, medicinal grade

- Strychnine and derivatives

- Sulfa drugs: bulk, uncompounded

- Sulfonamides

- Theobromine

- Vegetable gelatin (agar-agar)

- Vitamins, natural and synthetic: bulk, uncompounded

Description for 2834: Pharmaceutical Preparations

Division D: Manufacturing | Major Group 28: Chemicals And Allied Products | Industry Group 283: Drugs

2834 Pharmaceutical Preparations: Establishments primarily engaged in manufacturing, fabricating, or processing drugs in pharmaceutical preparations for human or veterinary use. The greater part of the products of these establishments are finished in the form intended for final consumption, such as ampoules, tablets, capsules, vials, ointments, medicinal powders, solutions, and suspensions. Products of this industry consist of two important lines, namely: (1) pharmaceutical preparations promoted primarily to the dental, medical, or veterinary professions, and (2) pharmaceutical preparations promoted primarily to the public.

- Adrenal pharmaceutical preparations

- Analgesics

- Anesthetics, packaged

- Antacids

- Anthelmintics

- Antibiotics, packaged

- Antihistamine preparations

- Antipyretics

- Antiseptics, medicinal

- Astringents, medicinal

- Barbituric acid pharmaceutical preparations

- Belladonna pharmaceutical preparations

- Botanical extracts: powdered, pilular, solid, and fluid, except

- Chlorination tablets and kits (water purification)

- Cold remedies

- Cough medicines

- Cyclopropane for anesthetic use (U.S.P. par N.F.), packaged

- Dermatological preparations

- Dextrose and sodium chloride injection, mixed

- Dextrose injection

- Digitalis pharmaceutical preparations

- Diuretics

- Effervescent salts

- Emulsifiers, fluorescent inspection

- Emulsions, pharmaceutical

- Fever remedies

- Galenical preparations

- Hormone preparations, except diagnostics

- Insulin preparations

- Intravenous solutions

- Iodine, tincture of

- Laxatives

- Liniments

- Lip balms

- Lozenges, pharmaceutical

- Medicines, capsuled or ampuled

- Nitrofuran preparations

- Ointments

- Parenteral solutions

- Penicillin preparations

- Pharmaceuticals

- Pills, pharmaceutical

- Pituitary gland pharmaceutical preparations

- Poultry and animal remedies

- Powders, pharmaceutical

- Procaine pharmaceutical preparations

- Proprietary drug products

- Remedies, human and animal

- Sodium chloride solution for injection, U.S.P.

- Sodium salicylate tablets

- Solutions, pharmaceutical

- Spirits, pharmaceutical

- Suppositories

- Syrups, pharmaceutical

- Tablets, pharmaceutical

- Thyroid preparations

- Tinctures, pharmaceutical

- Tranquilizers and mental drug preparations

- Vermifuges

- Veterinary pharmaceutical preparations

- Vitamin preparations

- Water decontamination or purification tablets

- Water, sterile: for injections

- Zinc ointment

Psychedelic Drugs Manufacturers Insurance - The Bottom Line

While there is no doubt about the fact that psychedelic drug manufacturing will increase exponentially over the next few years, insurance companies, for the most part, seem to be hesitant about covering businesses. Many of the reasons have to do with state-specific laws and ambiguity about individual products.

However, as the popularity of what could soon be a billion-dollar industry continues to skyrocket, there will be a growing number of insurance companies that have industry-specific insurance.

It will take time, and till then, businesses will have to work with insurers to get custom psychedelic drugs manufacturers insurance coverage if possible. While some insurers' coverage isn't perfect, we expect it is going to improve as the industry evolves.

Additional Resources For Manufacturing Insurance

Learn all about manufacturing insurance. Manufacturers face many unique risks such as product libility and/or product recall exposures due to the nature of their business operations.

- 3D Printing

- Adhesives

- Alarms

- Audio & Video Equipment

- Auto Parts

- Bottling Plants

- Boxes

- Bricks

- Brooms & Brushes

- Buttons

- Cabinets

- Camping Equipment

- Canned Fruit & Vegetables

- Cans

- Canvas Products

- Caskets

- CBD Oil And Hemp

- Cement

- Ceramics

- Chemical

- Clock & Watch

- Clothing

- Coffee

- Commercial Air Conditioning

- Commercial Electronics

- Communications Equipment

- Computers

- Condoms

- Construction Equipment

- Cork Products

- Cosmetics

- Cutlery

- Dairies & Creameries

- Down And Feather Products

- Dry Ice

- Dyes & Pigments

- Electronic Toys & Games

- Electroplating

- Elevators

- Engines

- Exercise Equipment

- Farm Equipment

- Feed & Grain

- Fences

- Fertilizer

- Fireworks

- Flavoring Extracts

- Frozen Foods

- Fruit Juice

- Fur Garment

- Garage Door

- Gears

- Glass

- Glasswear

- Gypsum Products

- Hosiery

- Ice Cream

- Industrial Equipment

- Ink

- Insecticides

- Iron & Steel Foundries

- Jewelry

- Lawn Mowers

- Leather Apparel

- Leather Goods

- Lighting & Wiring

- Lumber & Wood Products

- Machine Shop

- Major Electrical Appliances

- Manufacturing

- Marijuana Products

- Mattresses & Box Springs

- Metal & Plastic Furniture

- Metal Heat Treating

- Metal Toys

- Millwork

- Monuments

- Musical Instruments

- Nanotechnology

- Nonferrous Foundries

- Ornamental Metalwork

- Paint

- Paper & Allied Products

- Pesticides

- Pet Food

- Pharmaceuticals

- Plastic & Rubber Toys

- Plastic Goods

- Plastics

- Plastics Molding, Forming & Extruding

- Pottery

- Product Liability

- Prosthetics

- Psychedelic Drugs

- Pulp & Paper Mills

- Refractory

- Residential Air Conditioning & Heating

- Rubber Goods

- Rugs

- Sawmills & Planing Mills

- Screw Machine Products

- Sheet Metal

- Soap & Detergent

- Shoes

- Small Electrical Appliances

- Sporting Goods

- Springs

- Stone Products

- Tanneries

- Textiles

- Textiles Finishing & Coating

- Tires

- Tobacco

- Tool & Die Shops

- Vegetable Juice

- Vending Machines

- Watercraft

- Wire

- Wire Rope

- Wood Furniture

- Woodworking

- Writing Instruments

- Yarn

- Specialty Manufacturing

- Specialty Product Liability

The manufacturing industry is a vital part of the economy and plays a significant role in the production of goods and services. However, it is also an industry that is prone to risks and accidents, which can result in costly damages and lawsuits. Therefore, it is essential for businesses in the manufacturing industry to have insurance to protect them against potential losses.

Business insurance can cover a wide range of risks, including property damage, liability, and worker injuries. For instance, if a fire were to break out in a manufacturing facility and destroy equipment or inventory, commercial insurance could cover the costs of replacing or repairing the damages. Similarly, if a worker were to be injured on the job, business insurance could cover medical expenses and lost wages.

In addition to protecting against physical damages, insurance can also provide financial protection against legal liabilities. If a customer were to sue a manufacturing business for a faulty product, the commercial insurance could cover the costs of legal fees and settlements.

Overall, insurance is essential for the manufacturing industry as it helps to mitigate risks and protect against unexpected costs. Without it, businesses in the industry could face financial ruin in the event of an accident or lawsuit.

Minimum recommended small business insurance coverage: Building, Business Personal Property, Business Income with Extra Expense, Equipment Breakdown, Employee Dishonesty, Accounts Receivable, Computers, Goods in Transit, Valuable Papers and Records, General Liability, Employee Benefits Liability, Environmental Impairment Liability, Umbrella Liability, Hired and Non-owned Auto Liability & Workers Compensation.

Other commercial insurance policies to consider: Earthquake, Flood, Cyber Liability, Employment-related Practices Liability, Business Auto Liability and Physical Damage and Stop Gap Liability.